Revenio Group

23.95

EUR

+1.48 %

REG1V

NASDAQ Helsinki

Medical Equipment & Services

Health Care

Revenio is a global provider of comprehensive eye care diagnostic solutions. The group offers fast, user-friendly, and reliable tools for diagnosing glaucoma, diabetic retinopathy, and macular degeneration (AMD). Revenio’s ophthalmic diagnostic solutions include intraocular pressure (IOP) measurement devices (tonometers), fundus imaging devices, and perimeters as well as software solutions under the iCare brand. In 2023, the Group’s net sales totaled EUR 96.6 million, with an operating profit of EUR 26.3 million. Revenio Group Corporation is listed on Nasdaq Helsinki with the trading code REG1V.

Read moreRevenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

Interim report Q1'25

Interim report Q2'25

Interim report Q3'25

Risk

Revenio Q1'25 preview: Risks have increased significantly

Invitation to Revenio Group’s audiocast and teleconference call

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

PREMIUM account

Resolutions of Revenio Group Corporation's Annual General Meeting 2025 and the organizing meeting of the Board of Directors

Change in the amount of Revenio Group Corporation’s treasury shares

Case: Potential impacts of U.S. import tariffs on Helsinki Stock Exchange companies

Revenio Interim report 1-3/2025

Revenio: iCare MAIA microperimeter cleared for marketing in the US

U.S. FDA cleared the new iCare MAIA microperimeter

Notice to the Annual General Meeting of Revenio Group Corporation

Revenio Group Corporation’s annual reporting package 2024 has been published

Rewards of Revenio Group Corporation’s share plans RSP 2021-2023 and RSP 2024-2026

Revenio Group Corporation: Notification of change in holdings according to Chapter 9, Section 10 of the Finnish Securities Market Act

Revenio Q4'24: Outlook has more dark clouds than expected

Revenio Full Year 2024

Revenio Group Corporation: Financial Statements Release January 1 – December 31, 2024

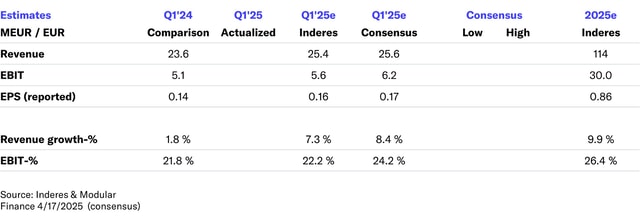

Modular Finance IR Consensus: Revenio Group – Consensus estimates Q4 2024