Kirjaudu sisään Inderes Free -tilillesi nähdäksesi kaikki sivun maksuton sisältö.

Penneo

Alle 1K seuraajaa

Penneo is a Danish Software-as-a-Service (SaaS) company delivering solutions for digital signing (Penneo Sign), document workflow, and compliance such as a Know Your Customer product (Penneo KYC) that helps companies comply with Anti Money Laundering (AML) legislation. Penneo was established in Denmark in 2014, and the company has more than 3,000 customers across Denmark, Sweden, Norway, Finland, and Belgium. Penneo is listed on Nasdaq Copenhagen Main Market.

Lue lisääViimeisimmät analyysit

Viimeisin analyysiraportti

Julkaistu: 30.08.2024

Kaikki

Analyysit

Webcastit

Tiedotteet

Kolmansien osapuolien sisällöt

NäytäKaikki sisältötyypit

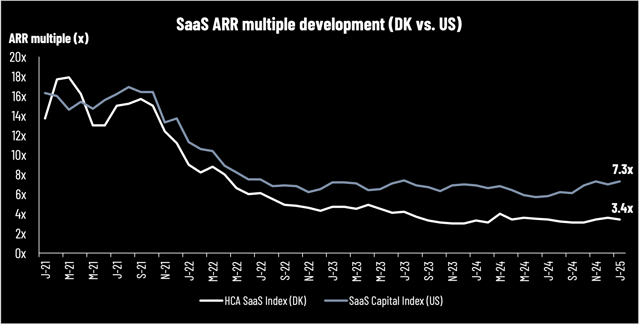

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

Penneo: Major Shareholder Announcement

Liity Inderesin yhteisöön

Älä jää mistään paitsi – luo käyttäjätunnus ja ota kaikki hyödyt irti Inderesin palvelusta.

FREE-tili

Pörssin suosituin aamukatsaus

Analyytikon kommentit ja suositukset

Osakevertailu

PREMIUM-tili

Kaikki yhtiöraportit ja sisällöt

Premium-työkalut (mm. sisäpiirin kaupat ja screeneri)

Mallisalkku