MapsPeople

0,85

DKK

+6,25 %

MAPS

First North Denmark

Software

Technology

MapsPeople is a Software-as-a-Service (SaaS) company focusing on digital mapping for indoor navigation. The two primary revenue streams are 1) MapsIndoors which is MapsPeople’s own developed mapping solution for indoor navigation 2) Google Maps partnership with Google. MapsIndoors is the key segment with high double-digit growth rates, and the Google Maps segment is expected to be a more steady business going forward. MapsPeople has a global presence with offices in Denmark, Germany, Singapore and United States, and customers include some of the largest brands in the world. The company has been listed at Nasdaq First North Premier in Denmark since June 2021.

Lue lisääViimeisimmät analyysit

Viimeisin analyysiraportti

Julkaistu: 11.03.2025

Pörssikalenteri

Osavuosikatsaus Q1'25

Osavuosikatsaus Q2'25

Osavuosikatsaus Q3'25

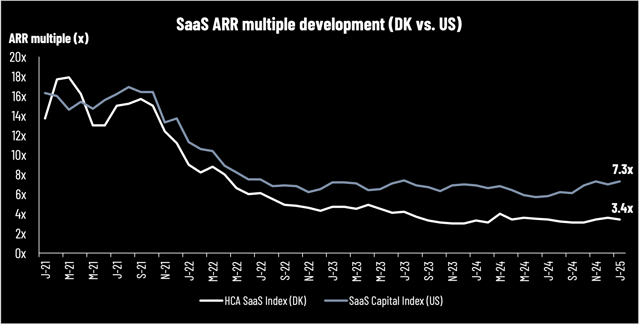

SaaS HCA update March 2025: Trend shows declining growth but improving profit

MapsPeople A/S: MapsPeople - Results of the ordinary general meeting on 24 March 2025

Liity Inderesin yhteisöön

Älä jää mistään paitsi – luo käyttäjätunnus ja ota kaikki hyödyt irti Inderesin palvelusta.

FREE-tili

PREMIUM-tili

MapsPeople (One-pager): Aims to accelerate ARR growth after transformative years

MapsPeople - Recording of FY 2024 presentation

MapsPeople – Presentation of Annual Report 2024

MapsPeople A/S: MapsPeople - Notice of annual general meeting

MapsPeople: Final 2024 results in line with the pre-announced expectations

MapsPeople A/S releases Annual Report 2024 with revenue growth of 54% and 50% improvement of EBITDA

MapsPeople A/S releases its Annual Report 2024 on Thursday March 6th and moves Annual General Meeting forward

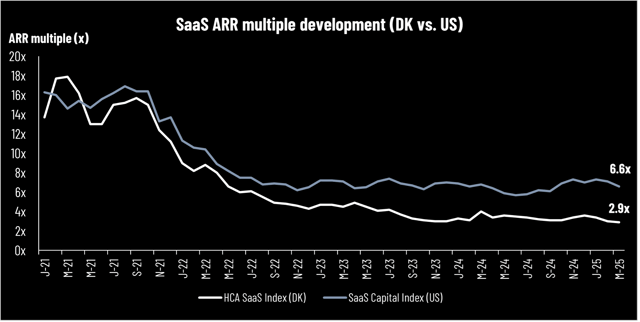

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

MapsPeople: Adjusts 2024 guidance, sets 2025 guidance and announces capital requirement

MapsPeople A/S adjust ARR expectations for 2024 and sets guidance for 2025

MapsPeople A/S: Capital requirement

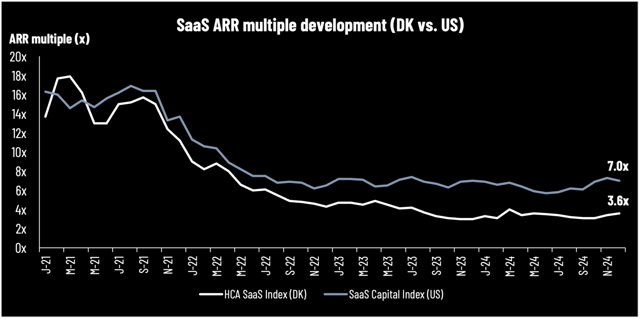

HCA SaaS update December 2024: Year-end update and a look into 2025

MapsPeople A/S: Grant of new warrants in connection with loan