Log in to your Inderes Free account to see all free content on this page.

Netum Group

2.62

EUR

0 %

Corporate customer

NETUM

First North Finland

IT Services

Technology

1,709 following

0%

-9.66%

-9.66%

-7.09%

0%

+0.77%

-38.13%

-

-41.12%

Netum operates in the IT sector. The company specializes in the development of software solutions. The software is self-developed and is mainly used for the design and implementation of software, management and monitoring of information systems, cyber security solutions, and for IT management. The customers consist of corporate customers operating in a number of sectors. In addition to the main business, various value-added services are offered. The largest operations are in the Nordic region.

Read moreMarket cap

33.5M EUR

Turnover

6.06K EUR

P/E (adj.) (24e)

EV/EBIT (adj.) (24e)

EV/S (24e)

Dividend yield-% (24e)

Coverage

Financial calendar

25.2.

2025

Annual report '24

25.3.

2025

General meeting '24

29.4.

2025

Business review Q1'25

Risk

Business risk

Valuation risk

Low

High

ShowingAll content types

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025

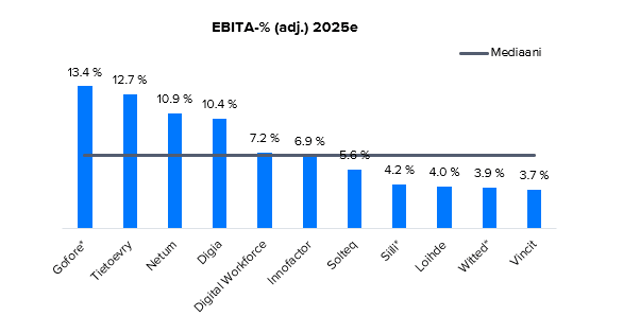

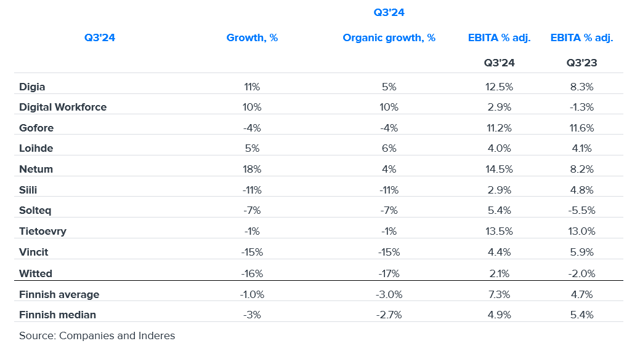

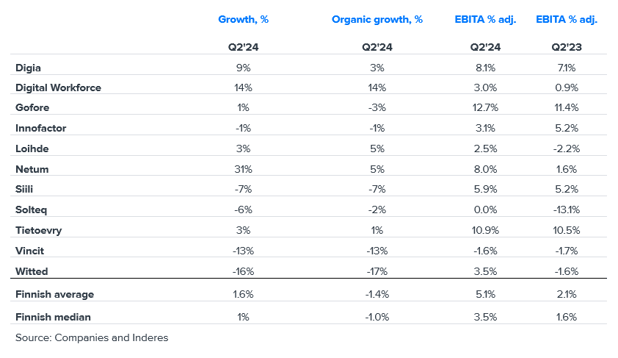

Q3 IT service sector summary: Revenue down but profitability up – sector shows clear divide

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

Netum Group Plc: Managers’ transactions – Köngäs

Netum Group Plc complements the publication of the financial statements, reports of the Board of Directors and auditors' reports for the years 2023 and 2022

The Board of Directors of Netum Group Plc decided on stock option plan for the CEO

Netum Group Plc’s business review 1 January – 30 September 2024: Revenue for January–September 2024 grew 28.2%, EBITA 11.5% of revenue

Netum Group Plc's schedule for financial reporting in the year 2025

Inside information: Repe Harmanen appointed CEO of Netum Group Plc as of 10 January 2025

IT service sector: Market performance in Denmark and Norway better than in Finland and Sweden

Inside information: Netum Group Plc's CEO Matti Mujunen to retire

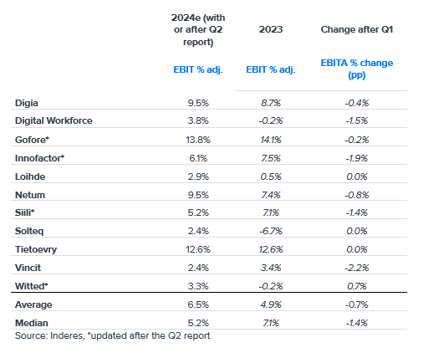

IT services sector 2024 expectations fell slightly in Q2, but H2 looks a little better

Netum Group Plc's CFO Mari Ala-Sorvari moves to a new role within the company - Peter Ahlskog appointed as new CFO

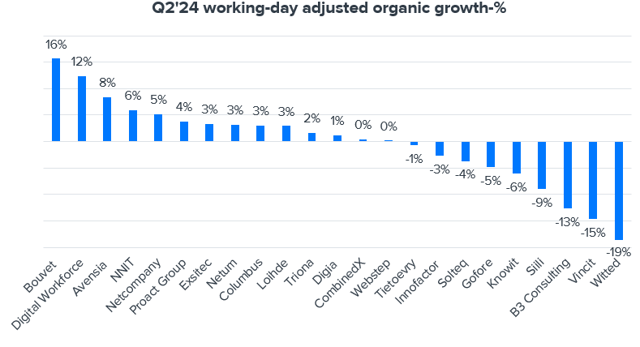

Q2 IT service sector summary: Slightly steeper revenue decline, improved profitability and signs of demand bottoming out

Netum Group Plc: Managers’ transactions – Köngäs