Log in to your Inderes Free account to see all free content on this page.

Loihde

12.3

EUR

-1.99 %

1,242 following

LOIHDE

First North Finland

IT Services

Technology

Overview

Financials & Estimates

Ownership

Investor consensus

-1.99%

-1.2%

+12.84%

+2.5%

+13.36%

-10.55%

-20.39%

-

-45.93%

Loihde is a service company for digital development and security. Among other things, it offers solutions in data analysis and data management, user experience design, software development, cloud services and services in cyber security and security technology. The customers consist of business customers operating in a number of different sectors. The largest operations are found in Finland and Sweden.

Read moreMarket cap

70.5M EUR

Turnover

20.02K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

EV/S (25e)

Dividend yield-% (25e)

Coverage

Latest research

Latest analysis report

Released: 02.11.2022

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

30.4.

2025

Business review Q1'25

8.5.

2025

General meeting '25

9.5.

2025

Annual dividend

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Loihde Plc: Managers’ Transactions – Konttinen

Loihde Plc: Managers’ Transactions – Ahola

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

Loihde Plc: Managers’ Transactions – Järvinen

Loihde Plc: Managers’ Transactions – Teutari

Loihde Plc: Managers’ Transactions – Suhonen

Loihde Plc: Managers’ Transactions – Meronen

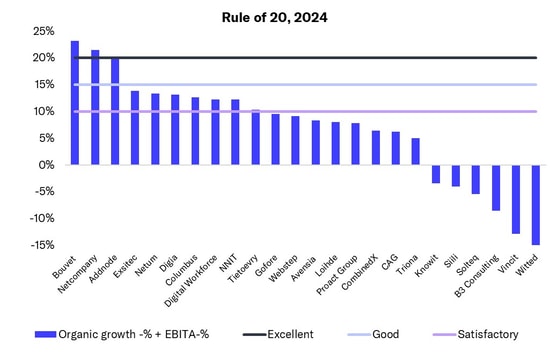

Outlook for the IT service sector 2025: Growth will kick off again at the end of the year

Loihde Plc: Managers’ Transactions – Teutari

Loihde Plc: Managers’ Transactions – Suhonen

Loihde Plc: Managers’ Transactions – Järvinen

Loihde Plc: Managers’ Transactions – Ahola

Loihde Plc: Managers’ Transactions – Meronen

Loihde’s Annual Report for 2024 has been published

Notice of Loihde Plc’s annual general meeting

Loihde Plc cancels treasury shares

Loihde Plc's Board of Directors decided on directed share issues as part of the share-based incentive schemes for employees and management