Log in to your Inderes Free account to see all free content on this page.

Digia

6.58

EUR

+2.49 %

7,263 following

DIGIA

NASDAQ Helsinki

IT Services

Technology

Overview

Financials & Estimates

Ownership

Investor consensus

+2.49%

-0.3%

+0.3%

-1.2%

+19.64%

+26.05%

-12.5%

+40%

+51.56%

Digia is an IT consulting company. The company specializes in system integration, web analysis, and internal processes that concern efficiency and decision management. The company's services are used in a number of sectors, from the financial sector to the grocery trade and the energy sector. The largest presence in the Nordic domestic market. Digia is headquartered in Helsinki.

Read moreMarket cap

176.5M EUR

Turnover

8.58K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

EV/S (25e)

Dividend yield-% (25e)

Latest research

Latest analysis report

Released: 09.02.2022

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

25.4.

2025

Business review Q1'25

7.8.

2025

Interim report Q2'25

23.10.

2025

Business review Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

3rd party

ShowingAll content types

Outlook for the IT service sector 2025: Growth will kick off again at the end of the year

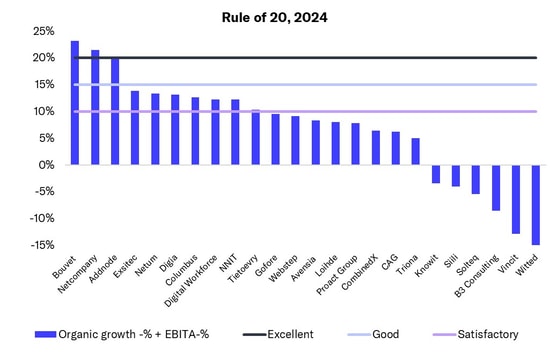

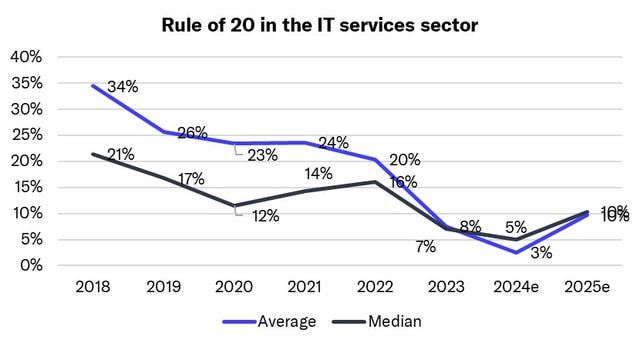

In the IT service sector, a few Nordic companies achieved excellent performance measured by the 'Rule of 20'

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

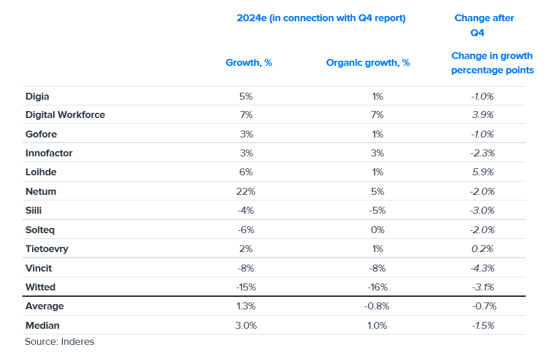

IT service sector: Q4 was tough, as was 2024

Digia Oyj: Digia Plc's annual reporting package 2024 published

Digia Oyj: Notice of Digia Plc's Annual General Meeting 2025

Digia Oyj: Digia Plc Financial Statement Bulletin 2024 (unaudited)

Introducing the Rule of 20: The best measure for IT services performance signals market softening

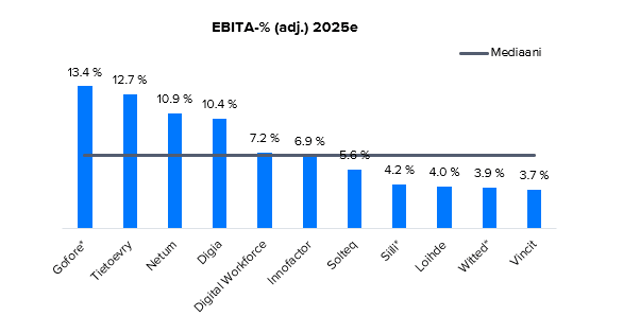

IT service sector: Bottom of cycle passed, grain will be separated from chaff in 2025

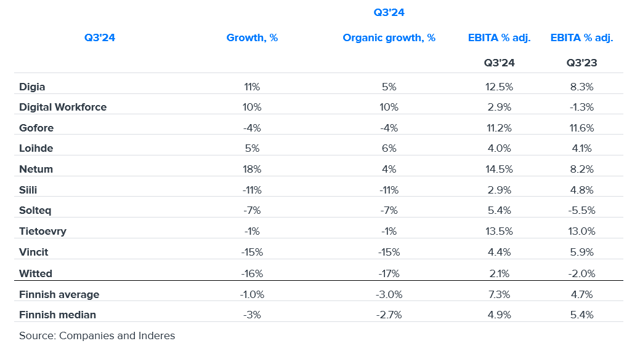

Q3 IT service sector summary: Revenue down but profitability up – sector shows clear divide

Digia Oyj: VSV Group in the energy sector seeks efficiency by renewing its ERP - Digia becomes a partner

Digia Oyj: Traficom chooses Digia as its integration partner - its position in the transport sector will be strengthened

Digia Oyj: Digia selected as NATO's framework agreement supplier - there is international demand for Finnish IT expertise in the defence and security sector

Digia Oyj: Digia Plc Business Review January-September 2024 (unaudited)

IT service sector: Market performance in Denmark and Norway better than in Finland and Sweden

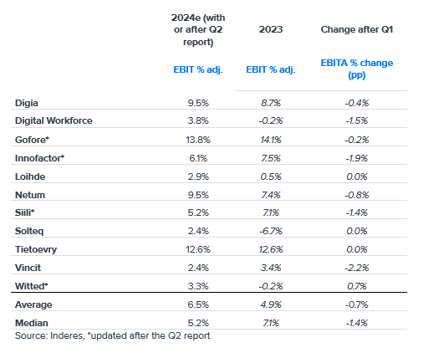

IT services sector 2024 expectations fell slightly in Q2, but H2 looks a little better

Digia Oyj: Digia's Financial Calendar and Annual General Meeting in 2025

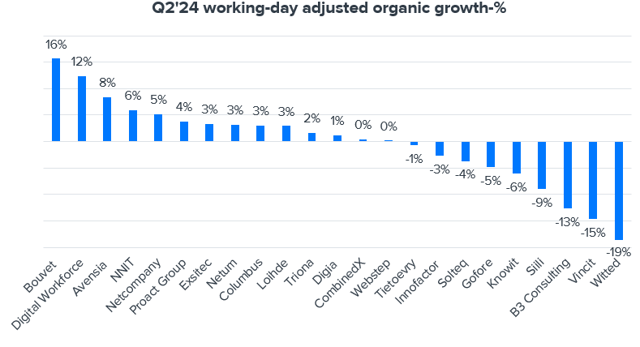

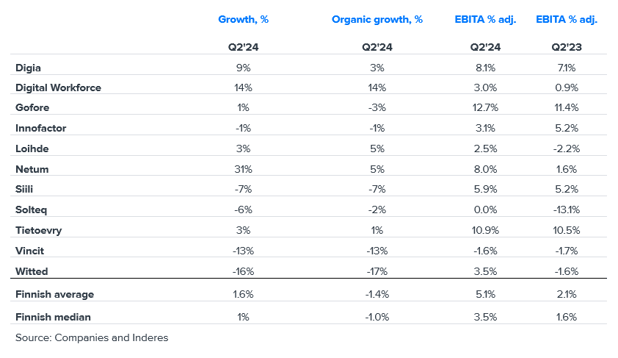

Q2 IT service sector summary: Slightly steeper revenue decline, improved profitability and signs of demand bottoming out

Digia Oyj: Digia Plc's Half-year Financial Report January-June 2024 (unaudited)