Log in to your Inderes Free account to see all free content on this page.

Taaleri

7.72

EUR

-0.26 %

8,817 following

TAALA

NASDAQ Helsinki

Financial Services

Financials

Overview

Financials & Estimates

Ownership

Investor consensus

-0.26%

0%

-3.86%

-2.89%

-4.57%

-20.98%

-40.39%

+28.24%

+157.33%

Taaleri operates in the financial sector. The company is a Nordic private equity fund company that focuses on renewable energy and other alternative investments. The company has two business segments: Equity Funds and Strategic Investments. With its capital funds, Taaleri creates, for example, wind and solar power, biofuels and real estate. The company was founded in 2007 and its head office is located in Helsinki, Finland.

Read moreMarket cap

217.68M EUR

Turnover

70.11K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Dividend yield-% (25e)

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

2.4.

2025

General meeting '25

3.4.

2025

Half year dividend

29.4.

2025

Interim report Q1'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

3rd party

ShowingAll content types

Impact of real estate fund issues on various Finnish asset managers

Notice to the Annual General Meeting of Taaleri Plc

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

Taaleri Plc – Managers’ transactions – Leif Frilund

Taaleri Plc – Managers’ transactions – Titta Elomaa

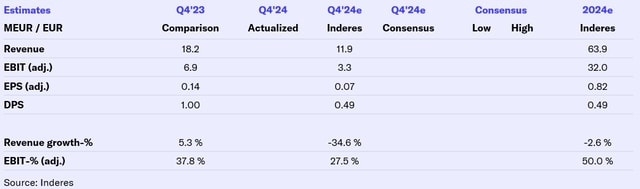

Taaleri Q4'24: Share remains firmly in the discount basket

Taaleri Financial Statements Bulletin 2024

Taaleri Q4'24 flash comment: Big earnings beat on non-recurring fees and outlook is clear

Changes in Taaleri’s management – Lauri Lipsanen appointed as CFO and member of the Executive Management Team

Taaleri Plc Interim Statement 1.1.–31.12.2024: Taaleri’s positive financial performance continued in the final quarter of the year

The proposal of Taaleri’s Shareholders’ Nomination Board for the composition and remuneration of the Board of Directors

Taaleri Q4’24 preview: Focus in this year’s strategy update

Taaleri will publish its Financial Statements Bulletin for 2024 on Wednesday, 12 February 2025

Taaleri establishes joint venture with Keva to invest in rental apartments

Taaleri Real Estate and Keva establish a joint venture investing in build-to-rent residential real estate

Taaleri Extensive Report: Capital allocation matters a lot

Change of CEO at Taaleri

Change in Taaleri Plc’s management – Elina Lintuala appointed Interim CFO and member of the Executive Management Team

Inside information: Change of Taaleri Plc’s CEO – Ilkka Laurila appointed as new CEO