Tokmanni Group

13.646

EUR

+1.14 %

TOKMAN

NASDAQ Helsinki

Retailers

Consumer Goods & Services

Tokmanni Group is a variety discount retailer in the Nordics. The group has stores in Finland, Sweden and Denmark under the brand names Tokmanni, Dollarstore, Big Dollar, Click Shoes and Miny. In addition, Tokmanni has online stores. Tokmanni's headquarter and logistics centres are located in Mäntsälä, Finland. Dollarstore is headquartered in Kista, Stockholm with a central warehouse in Örebro. The group own a procurement company located in Shanghai together with a Norwegian discount store chain Europris.

Read moreLatest research

Latest analysis report

Released: 10.03.2025

Revenue and EBIT-%

Revenue B

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

General meeting '25

Half year dividend

Business review Q1'25

Risk

Tokmanni Group Oyj: Tokmanni Group's Report by the Board of Directors and Financial Statements, Corporate Governance Statement and Remuneration Report for 2024 published

Tokmanni Group Oyj: Update to the Stock Exchange Release on 22 January 2025: Proposal of the Shareholders' Nomination Board for the Chairman of Tokmanni Group's Board of Directors

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

PREMIUM account

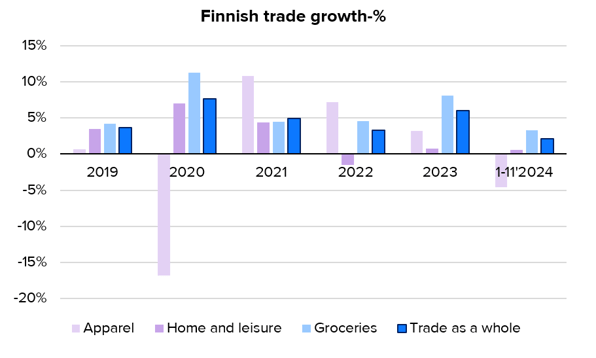

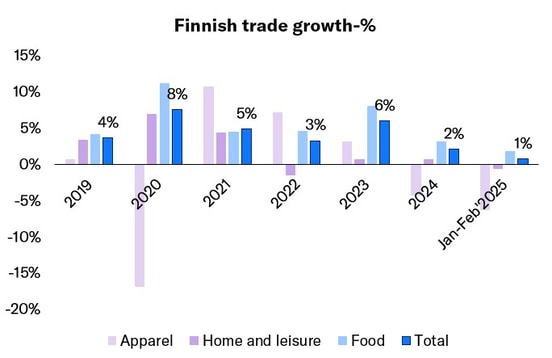

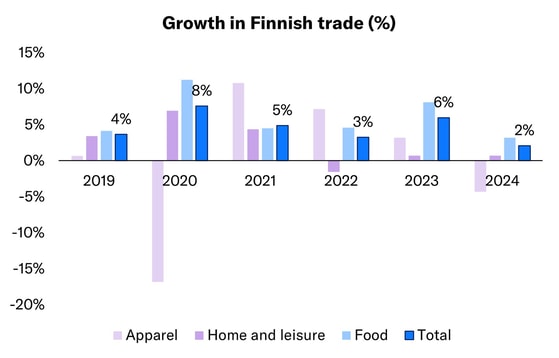

Finnish trade down in February

Tokmanni Group Oyj: Tokmanni Group Corporation: Managers' Transactions - Tapio Arimo

Tokmanni Group Oyj: Tokmanni Group Corporation: Managers' Transactions - Mika Rautiainen

Tokmanni Group Oyj: Change in the holding of Tokmanni Group Corporation's own shares

Tokmanni Q4’24: The story continues in the right direction

Tokmanni’s competitor Rusta grew strongly in its domestic market in Sweden

Tokmanni Q4'24: Revolving doors are spinning fast

Tokmanni Group Oyj: Tokmanni Group's Board of Directors confirmed the criteria for the new Performance Share Plan PSP 2025-2027 and realisation of the Restricted Share Plan RSP 2024-2026

Tokmanni Group Oyj: Tokmanni Group Corporation's Financial Statement Bulletin 2024: Revenue grew by 5.5% and comparable EBIT by 2.7% in the fourth quarter

Tokmanni Q4'24 preview: Strong result and guidance expected

Growth trend in Finnish trade in January followed last year's pattern

Lukewarm December seals sluggish trade year

Tokmanni Group Oyj: Proposal of the Shareholders' Nomination Board for the composition and remuneration of Tokmanni Group's Board of Directors

Tokmanni's analyst and press event at 2:00 pm EET

Tokmanni Group Oyj: Inside information: Tokmanni Oy has signed a licence agreement with SPAR International