Log in to your Inderes Free account to see all free content on this page.

Gabriel Holding

151

DKK

+2,03 %

Under 1K följer bolaget

GABR

NASDAQ Copenhagen

Home Products

Consumer Goods & Services

Översikt

Nyckeltal & Estimat

Investerarkonsensus

+2,03%

+4,14%

−7,36%

−16,11%

−41,47%

−43,23%

−75,84%

−76,77%

−20,53%

Gabriel Holding är verksamt inom textilbranschen. Bolaget utvecklar, konstruerar och säljer möbeltyger och tillhörande tjänster. En stor del av verksamheten består av tjänster inom design och konstruktion och utöver levereras affärssystem och konsulttjänster inom produktutveckling. Idag innehas verksamhet globalt med störst koncentration inom den europeiska marknaden. Huvudkontoret ligger i Aalborg.

Läs meraBörsvärde

285,39 mn DKK

Omsatt (värde)

37,75 tn DKK

P/E (just.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Direktavkastnings- % (25e)

Coverage

Omsättning & EBIT-%

Omsättning md

EBIT-%

Vinst per aktie & Utdelning

EPS (adj.)

Direktavkastning

Finansiell kalender

8.5.

2025

Delårsrapport Q2'25

28.8.

2025

Delårsrapport Q3'25

20.11.

2025

Bokslutskommuniké '25

Risk

Business risk

Valuation risk

Låg

Hög

Alla

Analys

Pressmeddelanden

Disclosure of transactions in the shares of Gabriel Holding A/S by persons discharging managerial responsibilities and closely related parties

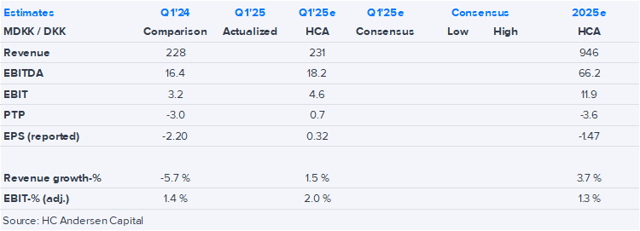

Gabriel Holding Q1'24-25: Q1’24-25 steady but carve-out uncertainty remains

Välkommen med i Inderes community!

Skapa ett gratis användarkonto och försäkra dig om att inte missa några börsnyheter av intresse för precis dig!

FREE account

Stock market's most popular morning newsletter

Tillgång till analytikerkommentarer och rekommendationer

Vårt eget aktiescreeningsverktyg

PREMIUM account

Alla aktieanalyser och övrigt innehåll

Premiumverktyg (insidertransaktioner och aktiescreeningsverktyg)

Inderes modellportfölj

Gabriel Holding Q1’24-25 preview: Carve out uncertainty raises near-term risk

Minutes of the annual general meeting on 29 January 2025

Gabriel FY'2023/24 video – Waiting for the carve-out to unlock value

Gabriel Holding FY'2023/24: Waiting for the carve-out to unlock value

Notice of annual general meeting of Gabriel Holding A/S

Irregularities in the Group’s Mexican FurnMaster company influence the 2023/24 financial year negatively and lead to corrections of previous years’ figures. Revenue for the year is DKK 912 million and the operating profit (EBIT) is DKK 10.9

Election of employee representative for the board of directors in Gabriel Holding A/S

Gabriel: FY’23/24 results delayed due to short-term uncertainties from accounts in Mexican unit

Financial reporting and general meeting for 2023/24 are postponed. Expectations for the continuing operations in the 2024/25 financial year are published.

Gabriel Holding's Chairman of the Board, Jørgen Kjær Jacobsen, does not seek re-election

Gabriel Holding A/S delivers rising revenue and operating profit (EBIT) in the third quarter of the 2023/24 financial year and maintains the upwardly adjusted expectations.

Gabriel Holding: Q3'23/24 earnings preview: Expecting seasonal softness but improving momentum

Gabriel Holding: Carve out of FurnMaster units and new growth strategy

Gabriel launches a new growth strategy to intensify development of the Gabriel Fabrics and SampleMaster business units. Carve-out of the Group’s FurnMaster units starts at the same time.

Gabriel Holding (Extensive research report video): Improving indicators suggest a return to growth