Log in to your Inderes Free account to see all free content on this page.

Ovaro Kiinteistösijoitus

3.60 EUR

+1.98 %

4,293 following

OVARO

NASDAQ Helsinki

Real Estate Management & Development

Real Estate

Overview

Financials & Estimates

Ownership

+1.98 %

+13.21 %

+12.50 %

+23.71 %

+5.26 %

+7.46 %

+28.57 %

-13.04 %

-65.05 %

Ovaro Kiinteistösijoitus focuses on real estate investments and in particular real estate development, primarily buying, developing and selling offices and land. Ovaro also owns and rents offices and apartments. The company operates in various parts of Finland, but focuses its operations on Finland's growth centers, i.e. university cities and the capital region.

Read moreMarket cap

30.96M EUR

Turnover

37.29K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Dividend yield-% (25e)

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

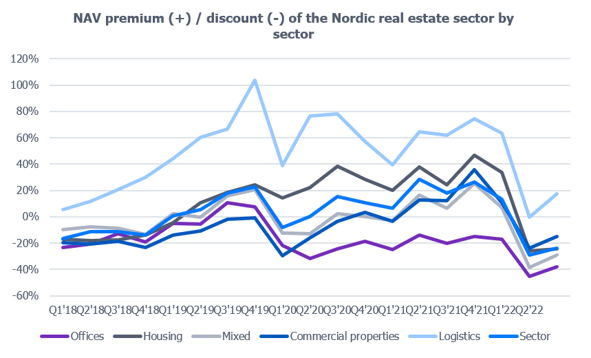

More challenging operating environment reflected in the valuation of the Nordic real estate sector

Ovaron asuntomyynti ja Ydintoiminnan vuokrausaste syyskuussa

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio