Log in to your Inderes Free account to see all free content on this page.

Spinnova

0.4

EUR

+6.67 %

5,459 following

SPINN

First North Finland

Personal Goods

Consumer Goods & Services

Overview

Financials & Estimates

Ownership

Investor consensus

+6.67%

-8.15%

-58.63%

-59.02%

-72.71%

-75.34%

-95.41%

-

-95.79%

Spinnova operates in the textile industry. The company has developed a production technology for textile fibers, known as SPINNOVA® fiber, which is manufactured using a mechanical production process. In addition to the main operations, research and development are conducted in the area and the company offers service and associated ancillary services. Spinnova operates worldwide and is headquartered in Jyväskylä.

Read moreMarket cap

20.92M EUR

Turnover

12.22K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Dividend yield-% (25e)

Coverage

Head of Research

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

28.8.

2025

Interim report Q2'25

12.2.

2026

Annual report '25

15.4.

2026

General meeting '26

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Spinnova's and Suzano's joint venture, Woodspin, assesses conditions for continuing its operations

Inside Information: Spinnova's joint venture Woodspin to initiate change negotiations

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

Spinnova’s co-founder and Chair of the Board also takes over the position of CEO

Inside Information: Spinnova's founder and Chair of the Board Janne Poranen to start as CEO. He will also continue as Chair of the Board

Spinnova's CEO will change

Inside Information: Spinnova Plc's CEO Tuomas Oijala to leave the Company

Notice to the General Meeting 2025 of Spinnova Plc

Proposals of the Shareholders' Nomination Board to Spinnova Plc's Annual General Meeting 2025

Spinnova: TKO'd by Suzano

Spinnova: Suzano withdraws from collaboration, forcing major strategic review

Inside Information: Suzano will not invest into next steps of collaboration with Spinnova. The companies will begin a strategic review of Woodspin and will renegotiate the exclusivity rights.

Spinnova Q4'24: Burden of proof is still heavy

Spinnova's Governance, Remuneration and Financial Statements 2024 has been published

Spinnova, Webcast, Q4'24

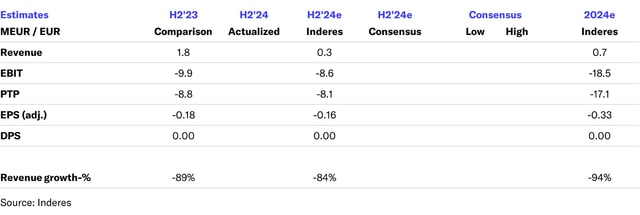

Spinnova H2'24 flash comment: Suzano project timeline still unclear

Spinnova Plc's Financial Statements Bulletin January-December 2024: Technology sales strategy and key partnerships progressed. Revenues and operating results are in line with guidance