Log in to your Inderes Free account to see all free content on this page.

Nexstim

7.98

EUR

+2.57 %

5,434 following

NXTMH

First North Finland

Medical Equipment & Services

Health Care

Overview

Financials & Estimates

Ownership

Investor consensus

+2.57%

-3.39%

-13.07%

+1.01%

+84.72%

+238.14%

+48.88%

+761.17%

-98.68%

Nexstim operates in medical technology. The company has developed a non-invasive brain stimulation technology called SmartFocus®. It is a navigated transcranial magnetic stimulation (nTMS) technology with 3D navigation providing targeting of the TMS to the specific area of the brain. The technology is aimed for the treatment of major depression and chronic neuropathic pain. The company was founded in 2000 and has its headquarters in Helsinki.

Read moreMarket cap

57.32M EUR

Turnover

67.24K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Dividend yield-% (25e)

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

15.8.

2025

Interim report Q2'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Press releases

ShowingAll content types

Nexstim Receives System Order from US University

Nexstim Plc: Resolutions of the Annual General Meeting of Shareholders

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

Nexstim Plc: Managers’ Transactions, Karvinen

Nexstim Plc: Invitation to the Annual General Meeting

Nexstim Plc Publishes 2024 Annual Report

Nexstim: Returning to the buy side after a share price decline

Nexstim Plc: Managers’ Transactions, Weckroth

Nexstim Plc: Managers’ Transactions, Weckroth

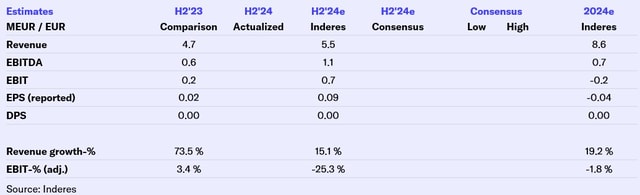

Nexstim H2'24: Solid growth in line with expectations

NEXSTIM PLC’S FINANCIAL STATEMENTS BULLETIN 2024