Log in to your Inderes Free account to see all free content on this page.

Anora Group

3.265

EUR

+0.31 %

5,519 following

ANORA

NASDAQ Helsinki

Food & Beverage

Consumer Goods & Services

Overview

Financials & Estimates

Ownership

Investor consensus

+0.31%

-6.18%

+17.66%

+14.96%

-6.18%

-32.89%

-62.81%

-57.04%

-57.71%

Anora Group is a producer of alcoholic beverages. The product portfolio consists of wine and spirits marketed under various brands. The largest operations are found in the Nordics and the Baltics, and the company's products are exported to retailers in Europe and North America. The company was created through a merger of Altia and Arcus in 2021 and has its headquarters in Helsinki.

Read moreMarket cap

220.56M EUR

Turnover

86.97K EUR

P/E (adj.) (25e)

EV/EBIT (adj.) (25e)

P/B (25e)

EV/S (25e)

Dividend yield-% (25e)

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

7.5.

2025

Interim report Q1'25

15.8.

2025

Interim report Q2'25

31.10.

2025

Interim report Q3'25

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

Press releases

ShowingAll content types

Decisions taken by Anora's Annual General Meeting 2025 and the organisational meeting of the Board of Directors

Anora Extensive Report: Cash flow supports, creating growth a challenge

Join Inderes community

Don't miss out - create an account and get all the possible benefits

FREE account

Stock market's most popular morning newsletter

Analyst comments and recommendations

Stock comparison tool

PREMIUM account

All company reports and content

Premium tools (e.g. insider transactions & stock screener)

Model portfolio

Anora's Annual Report for 2024 has been published

Anora Group Plc: Notice of the Annual General Meeting 2025

Anora: Kirsi Puntila appointed CEO

Inside information: Kirsi Puntila appointed as new CEO of Anora

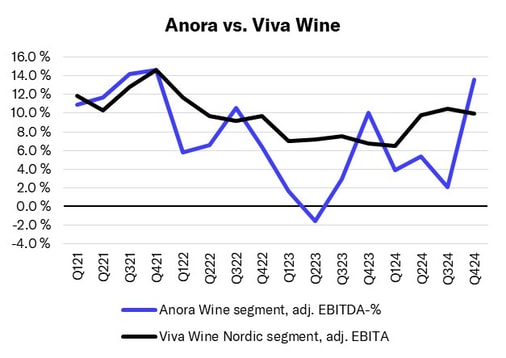

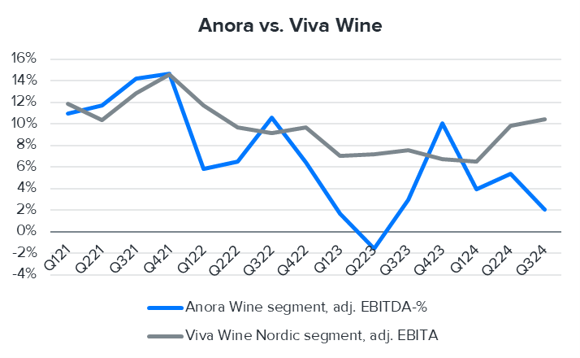

Anora: Good growth from Viva Wine, the main competitor in wines, in Q4 as usual

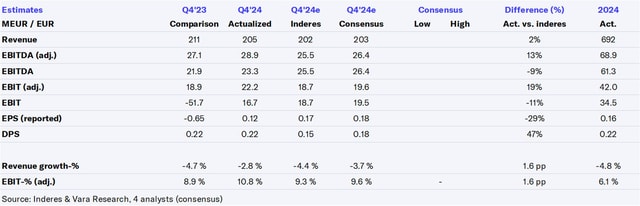

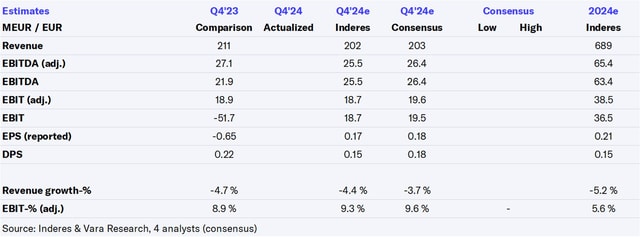

Anora Q4'24: Reasonable cash flow and dividend

Anora Q4'24

Anora Q4'24 flash comment: Slightly better than expected across the board

Anora Group's Board of Directors decided on a new plan period within the share-based long-term incentive scheme for the management and selected key employees

Anora Group Plc's Financial Statement Release for 1 January - 31 December 2024: Comparable EBITDA improved in Q4 driven by strong performance in the Wine segment

Anora Q4'24 preview: Earnings risk more to the upside

Proposals by Anora's Shareholders' Nomination Board to the Annual General Meeting 2025

Anora: No support from the market

Anora expands in Lithuania

Anora: Viva Wine, the main competitor in wines, continued its good development in Q3

Anora Q3'24: No significant upward turn in sight